The Problem

Payment fraud across the EEA reached €4.2 billion in 2024, up 17% from 2023, with credit transfers accounting for €2.5 billion and significant cross-border exposure. Cross-border card payments saw fraud 17 times higher outside the EEA, while manipulation of payers drove over half of fraudulent credit transfer value. Instant SEPA faces up to €1 billion in projected fraud losses amid uneven PSP readiness.

Forecasting emerging fraud schemes in SEPA corridors is challenging due to fragmented real-time data sharing, sophisticated social engineering, and regulatory pressures from mandatory instant payments by 2025. Banks struggle with 10x higher fraud risks in instant payments versus traditional transfers, lacking pan-European intelligence for proactive defense.

Current solutions focus on real-time detection but fail at predictive forecasting across EU borders, leaving institutions reactive to APP scams and exemptions under PSD2 SCA—resulting in 85% user-borne losses for credit transfers.

Our Approach

Key elements of this implementation

-

Time-series analytics with graph neural networks on anonymized SEPA transaction graphs for 30-90 day fraud vector forecasting

-

Native integration with SWIFT, EBA CLEARING FPAD, and core banking systems (Temenos, Finastra) via secure APIs

-

PSD2 SCA alignment, GDPR data minimization with EU residency, AMLD transaction monitoring, DORA resilience testing, and immutable blockchain audit trails

-

Phased rollout with 60-day pilot, executive-sponsored change champions, and human-in-loop validation for high-confidence alerts

Get the Full Implementation Guide

Unlock full details including architecture and implementation

Implementation Overview

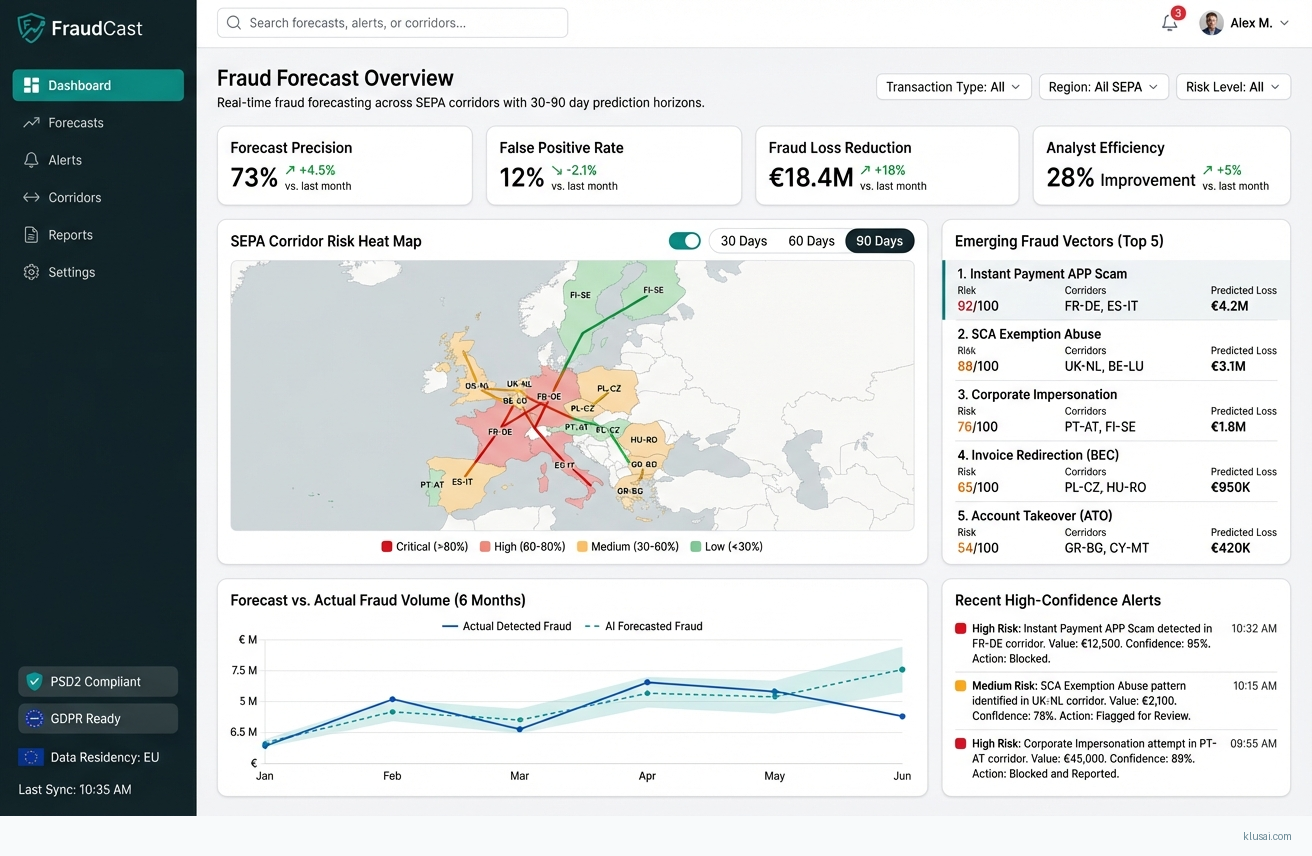

This implementation addresses the €4.2 billion annual payment fraud challenge across the EEA [1] through a predictive forecasting system that identifies emerging fraud patterns 30-90 days before they materialize at scale. Unlike reactive detection systems that respond to known patterns, this architecture builds temporal graph representations of SEPA transaction flows to forecast novel fraud vectors, enabling proactive defensive measures.

The architecture employs a phased data strategy beginning with single-institution deployment before expanding to voluntary consortium participation. Graph neural networks process anonymized transaction graphs to generate entity embeddings that capture behavioral patterns across time, while time-series forecasting models project these patterns forward to identify emerging risks. This approach directly addresses the 10x higher fraud risk in instant payments [5] and the €1 billion projected losses in Instant SEPA [3] by providing actionable intelligence before fraud campaigns reach critical mass.

Key architectural decisions prioritize regulatory compliance (PSD2 SCA alignment, GDPR data minimization, DORA operational resilience), operational pragmatism (cryptographically-signed append-only audit logs rather than over-engineered blockchain), and production sustainability (comprehensive model monitoring with automated drift detection and retraining triggers). The 7-9 month timeline reflects realistic regulatory validation requirements while delivering incremental value through phased deployment.

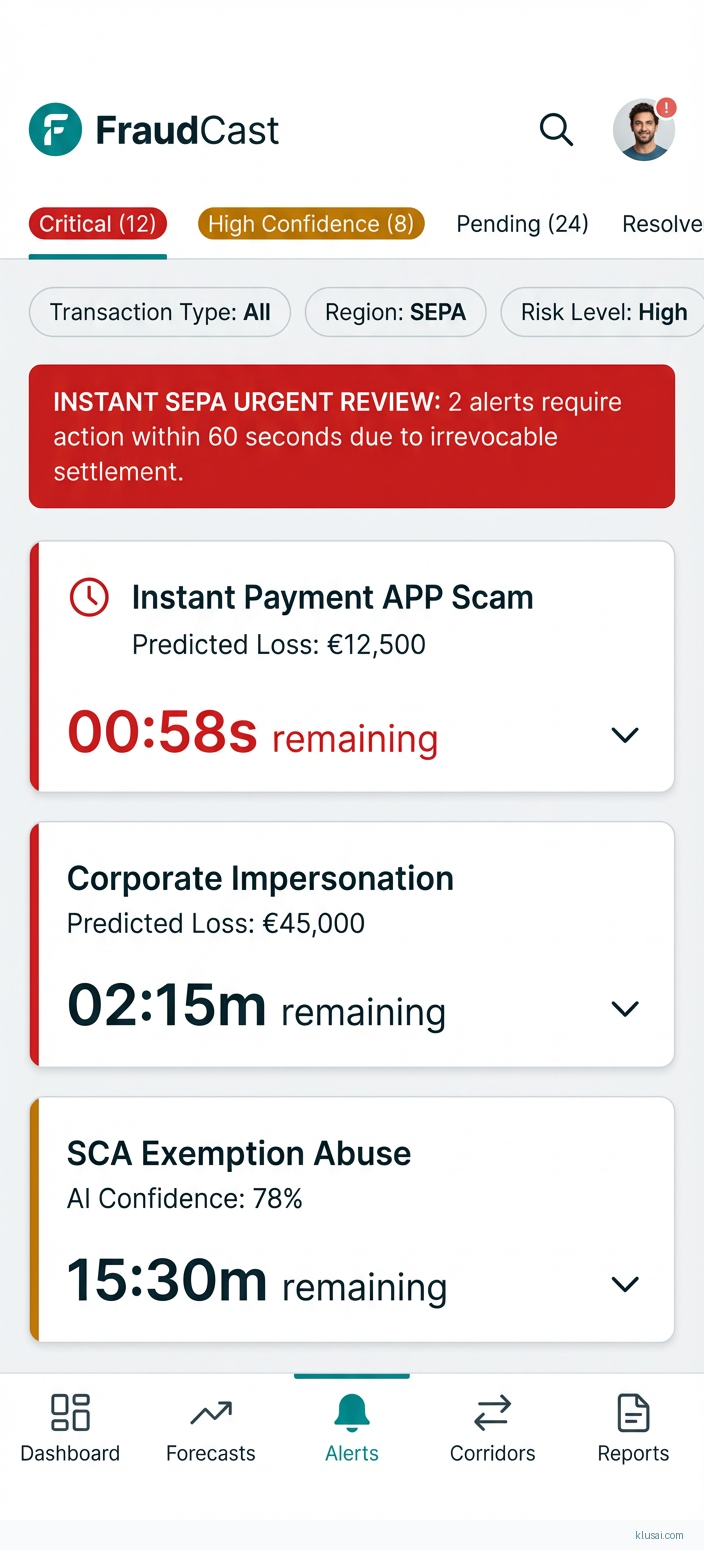

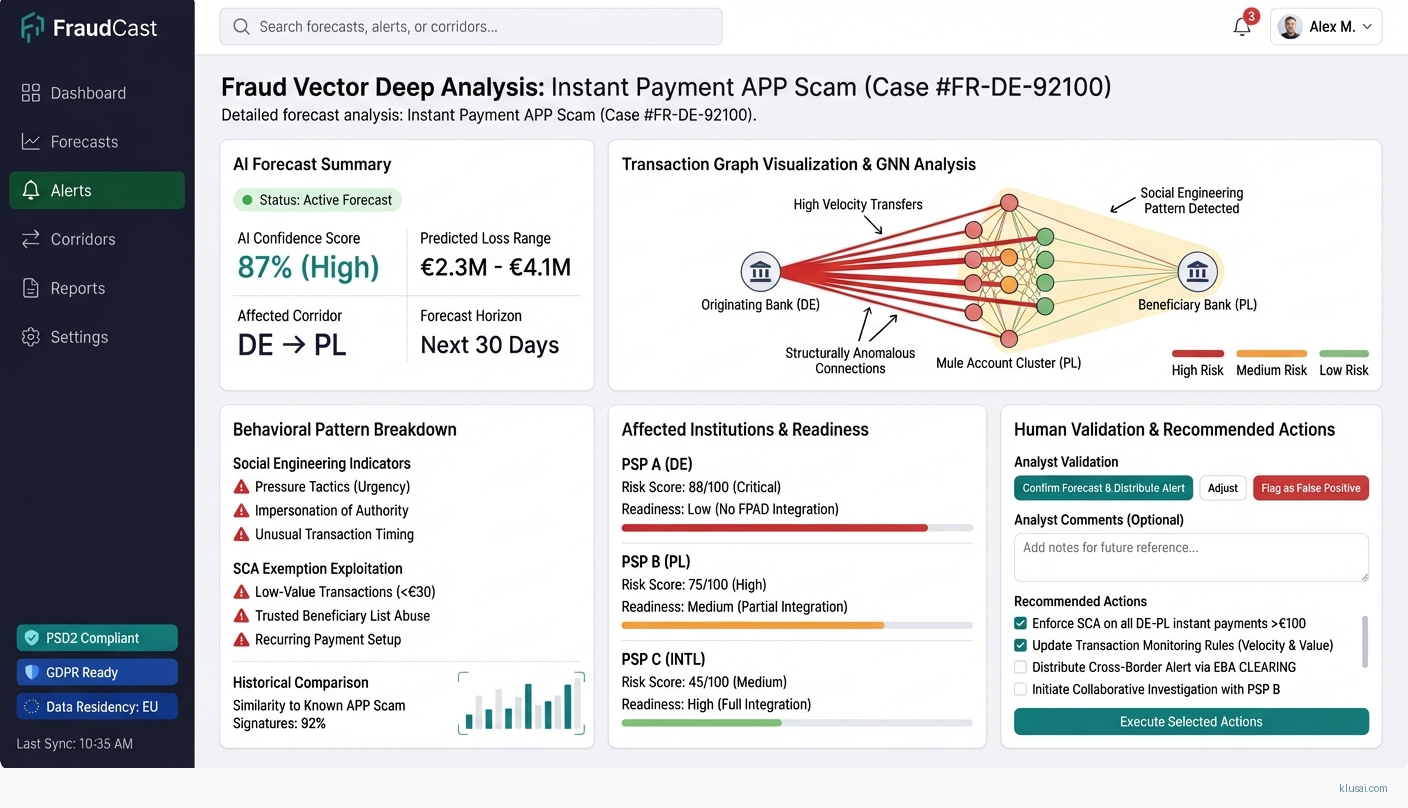

UI Mockups

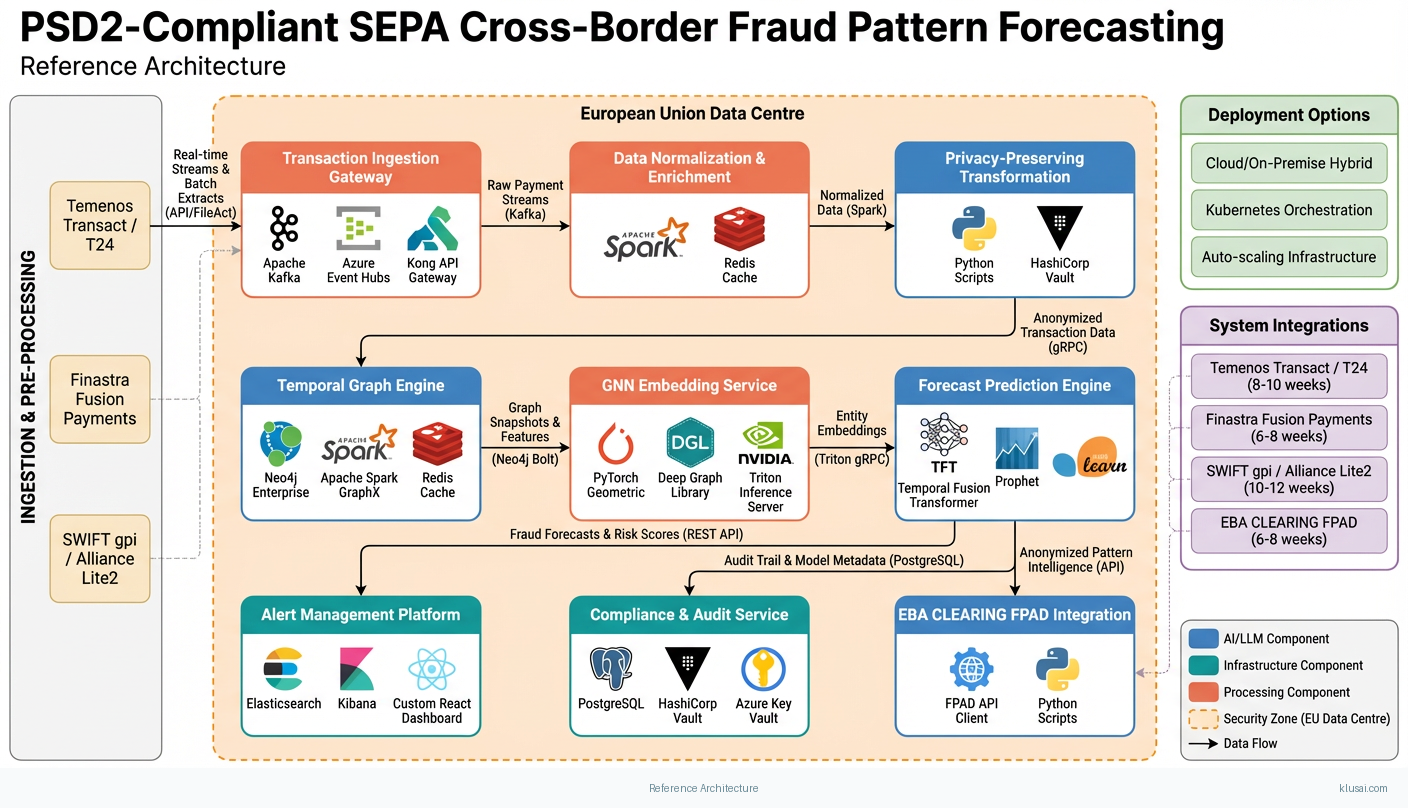

System Architecture

The architecture follows a layered approach with clear separation between data ingestion, graph construction, ML inference, and operational delivery. The ingestion layer connects to SWIFT, EBA CLEARING FPAD, and core banking systems through secure API gateways, normalizing heterogeneous transaction formats into a unified event stream. Data residency partitioning ensures EU-resident data remains within designated regions, with separate graph database clusters for different regulatory jurisdictions.

The graph construction layer transforms transaction events into temporal knowledge graphs where nodes represent entities (accounts, merchants, devices) and edges represent transaction relationships with temporal attributes. This layer implements GDPR data minimization through k-anonymization and differential privacy techniques, ensuring that individual transactions cannot be reconstructed from graph embeddings while preserving fraud-relevant patterns.

The ML inference layer employs a two-stage architecture: Graph Attention Networks (GAT) generate entity embeddings capturing behavioral patterns, while temporal convolutional networks project these embeddings forward to identify emerging anomalies. Model outputs feed into a calibrated alert system with human-in-loop validation for high-confidence forecasts, ensuring analyst workflows integrate seamlessly with existing fraud investigation processes.

The operational layer provides forecast dashboards, alert management, and regulatory reporting capabilities. Cryptographically-signed append-only logs maintain immutable audit trails satisfying DORA requirements without the operational complexity of distributed ledger technology. Comprehensive observability infrastructure monitors model performance, forecast accuracy, and system health with automated alerting for drift detection.

Key Components

| Component | Purpose | Technologies |

|---|---|---|

| Transaction Ingestion Gateway | Secure, normalized ingestion of SEPA transaction data from multiple sources with data residency enforcement | Apache Kafka Azure Event Hubs Kong API Gateway |

| Temporal Graph Engine | Constructs and maintains temporal knowledge graphs from transaction streams with privacy-preserving transformations | Neo4j Enterprise Apache Spark GraphX Redis Cache |

| GNN Embedding Service | Generates entity embeddings using Graph Attention Networks trained on anonymized transaction patterns | PyTorch Geometric DGL NVIDIA Triton Inference Server |

| Forecast Prediction Engine | Projects entity embeddings forward 30-90 days to identify emerging fraud vectors and risk concentrations | Temporal Fusion Transformer Prophet scikit-learn |

| Alert Management Platform | Prioritizes forecasts for analyst review with human-in-loop validation and feedback capture | Elasticsearch Kibana Custom React Dashboard |

| Compliance & Audit Service | Maintains immutable audit trails and generates regulatory reports for PSD2, AMLD, and DORA requirements | PostgreSQL with append-only tables HashiCorp Vault Azure Key Vault |

Technology Stack

Implementation Phases

Foundation & Single-Institution Pilot

Establish secure data ingestion from pilot institution's core banking system with GDPR-compliant data handling

- • Establish secure data ingestion from pilot institution's core banking system with GDPR-compliant data handling

- • Deploy initial graph construction pipeline for single-corridor transaction analysis (e.g., DE-NL or FR-BE)

- • Validate baseline fraud detection accuracy against historical labeled data with 60%+ precision target

- Production-ready ingestion pipeline with data quality monitoring and residency enforcement

- Initial GNN model trained on 6-month historical data with documented performance baseline

- Analyst dashboard prototype with alert prioritization and feedback capture mechanisms

Model Refinement & Multi-Corridor Expansion

Extend graph construction to 3-5 additional SEPA corridors with cross-border transaction linkage

- • Extend graph construction to 3-5 additional SEPA corridors with cross-border transaction linkage

- • Implement 30-day forecast capability with 65%+ precision on emerging pattern detection

- • Integrate with EBA CLEARING FPAD for pan-European intelligence enrichment

- Multi-corridor graph model with validated cross-border entity resolution

- Forecast engine producing 30-day predictions with calibrated confidence scores

- FPAD integration delivering external fraud intelligence enrichment to entity profiles

Production Hardening & Regulatory Validation

Achieve 70%+ precision on 30-day forecasts with <15% false positive rate in production traffic

- • Achieve 70%+ precision on 30-day forecasts with <15% false positive rate in production traffic

- • Complete DORA operational resilience testing including disaster recovery and business continuity

- • Obtain regulatory sign-off from pilot institution's compliance and risk functions

- Production-hardened system with comprehensive monitoring, alerting, and incident response procedures

- DORA compliance documentation including resilience test results and remediation evidence

- Regulatory approval package with model validation report and ongoing monitoring framework

Consortium Expansion & Long-Horizon Forecasting

Onboard 2-3 additional institutions to voluntary data-sharing consortium with appropriate governance

- • Onboard 2-3 additional institutions to voluntary data-sharing consortium with appropriate governance

- • Extend forecast horizon to 60-90 days with maintained precision targets

- • Establish automated model retraining pipeline with drift detection and performance monitoring

- Consortium data governance framework with legal agreements and technical data-sharing protocols

- Extended forecast models with 60-day (60%+ precision) and 90-day (55%+ precision) capabilities

- Automated MLOps pipeline with weekly retraining, A/B testing, and rollback capabilities

Key Technical Decisions

Should we use blockchain for audit trail immutability or a simpler cryptographic approach?

DORA requires demonstrable audit trail integrity, not distributed consensus. Append-only tables with cryptographic signing (each record includes hash of previous record) provide equivalent tamper-evidence with dramatically lower operational complexity. Blockchain adds consensus overhead, operational complexity, and potential availability risks without regulatory benefit for single-institution deployment.

- 90% reduction in audit infrastructure complexity and operational overhead

- Simpler disaster recovery and backup procedures

- Less suitable if future requirement emerges for multi-party audit verification

- Requires careful key management for signing certificates

What graph database architecture supports pan-European scale with data residency requirements?

GDPR data residency requirements necessitate keeping transaction data within designated regions, but fraud patterns cross borders. Regional Neo4j clusters (e.g., DACH, Benelux, Nordics) maintain data locality while a separate entity resolution service creates anonymized cross-references for pan-European pattern detection. This approach scales to projected 500M+ daily SEPA transactions while maintaining compliance.

- Clear data residency boundaries satisfying GDPR requirements

- Independent scaling per region based on transaction volume

- Cross-border queries require additional latency for entity resolution

- Increased operational complexity managing multiple clusters

How should we handle model retraining frequency given evolving fraud patterns?

Fraud patterns evolve continuously, with new social engineering techniques and APP scam variants emerging regularly. Weekly retraining balances model freshness against computational cost and validation overhead. Automated drift detection (monitoring embedding distribution shifts and forecast accuracy degradation) triggers emergency retraining when patterns change rapidly, ensuring the system adapts to emerging threats.

- Maintains model relevance as fraud patterns evolve

- Automated pipeline reduces operational burden

- Requires robust A/B testing to prevent regression

- Weekly retraining consumes significant GPU compute resources

What precision/recall tradeoff is appropriate for 30-90 day forecasts?

Longer forecast horizons inherently reduce precision as uncertainty compounds. Industry benchmarks for fraud detection (not forecasting) typically achieve 80-90% precision on known patterns; forecasting novel patterns is fundamentally harder. Tiered confidence thresholds ensure analysts see only high-confidence forecasts initially, with lower-confidence predictions available for strategic planning rather than immediate action.

- Realistic targets that can be validated and improved iteratively

- Tiered approach manages analyst workload while preserving strategic value

- Lower precision at longer horizons may limit immediate operational impact

- Requires careful communication to stakeholders about forecast limitations

Integration Patterns

| System | Approach | Complexity | Timeline |

|---|---|---|---|

| Temenos Transact / T24 | Real-time transaction streaming via Temenos Transact Event Hub with batch reconciliation through Temenos Data Lake extracts; bidirectional alert integration through Temenos Financial Crime Mitigation APIs | high | 8-10 weeks |

| Finastra Fusion Payments | ISO 20022 message extraction via Fusion Fabric.cloud APIs; alert injection through Fusion Risk and Compliance module; batch historical data via Fusion Data Exchange | medium | 6-8 weeks |

| SWIFT gpi / Alliance Lite2 | SWIFT gpi Tracker API for cross-border payment visibility; Alliance Lite2 FileAct for batch transaction data; SWIFT KYC Registry integration for entity enrichment | high | 10-12 weeks |

| EBA CLEARING FPAD | FPAD API integration for pan-European fraud pattern intelligence; contribution of anonymized pattern data to collective intelligence; real-time alert enrichment from FPAD threat feeds | medium | 6-8 weeks |

ROI Framework

ROI is driven by fraud loss reduction through early pattern detection enabling proactive controls, operational efficiency gains from prioritized alert queues reducing analyst investigation time, and regulatory compliance cost avoidance through automated DORA reporting. The framework uses conservative assumptions validated during pilot operations, with fraud reduction rates at the lower end of comparable predictive analytics implementations.

Key Variables

Example Calculation

Build vs. Buy Analysis

Internal Build Effort

Internal build would require 18-24 months with a team of 10-14 specialists including graph ML engineers (scarce talent pool), financial crime domain experts, and compliance architects familiar with PSD2/DORA requirements. Estimated build cost of €3.5-5.5M before operational expenses, with significant execution risk given the specialized nature of GNN development and evolving regulatory requirements. Most institutions lack internal graph ML expertise, requiring extensive hiring or contractor engagement.

Market Alternatives

NICE Actimize X-Sight

€500K-2M annually depending on transaction volume and module selectionEnterprise fraud management platform with network analytics capabilities; market leader in real-time detection with strong regulatory acceptance, but predictive forecasting limited to pattern matching on known fraud types rather than novel pattern prediction

- • Established vendor with proven regulatory acceptance across EEA

- • Comprehensive case management and regulatory reporting

- • Strong integration ecosystem with major core banking platforms

- • Forecasting limited to pattern matching rather than true 30-90 day prediction

- • Less flexibility for custom graph analytics on institution-specific patterns

- • Significant implementation timeline (12-18 months typical)

Featurespace ARIC

€400K-1.5M annually based on transaction volumeAdaptive behavioral analytics with strong instant payments focus; good real-time detection with emerging predictive capabilities, but forecast horizon typically limited to 7-14 days

- • Strong adaptive learning for evolving fraud patterns

- • Good SEPA Instant support with sub-second response times

- • Lighter implementation footprint than enterprise platforms

- • Graph-based analysis less mature than transactional behavioral models

- • Forecasting horizon typically <14 days, insufficient for proactive defense

- • Limited pan-European consortium capabilities

SAS Fraud Management

€600K-2.5M annually plus implementation servicesComprehensive analytics platform with strong regulatory reporting and model flexibility; requires significant customization for predictive forecasting use case

- • Deep analytics capabilities with extensive model customization options

- • Strong regulatory compliance features and audit trail

- • Established presence in European financial services

- • Graph neural network capabilities require custom development

- • Implementation complexity and timeline often exceeds estimates

- • Licensing model can become expensive at scale

Our Positioning

KlusAI's approach is optimal for institutions requiring true 30-90 day predictive forecasting beyond pattern matching, custom integration with existing fraud infrastructure, and flexibility to adapt as PSD2/DORA requirements evolve. We assemble specialized teams combining graph ML expertise with financial crime domain knowledge, delivering capabilities that packaged solutions cannot match while avoiding the timeline risk and talent acquisition challenges of pure internal builds. Our phased approach delivers incremental value while building toward full capability.

Team Composition

KlusAI assembles specialized teams tailored to each engagement, combining technical expertise in graph machine learning with financial crime domain knowledge and European regulatory experience. Team composition scales across phases, with core technical roles throughout and domain specialists engaged for specific workstreams.

| Role | FTE | Focus |

|---|---|---|

| Solutions Architect | 1.0 | Overall architecture design, integration patterns, and technical decision-making across the implementation; coordinates with client enterprise architecture and security teams |

| Graph ML Engineer | 2.0 | GNN model development, training pipeline implementation, embedding optimization, and forecast model development |

| Data Engineer | 1.5 | Transaction ingestion pipelines, graph database management, data quality assurance, and ETL pipeline development |

| Financial Crime Domain Specialist | 0.5 | Fraud pattern validation, analyst workflow design, regulatory requirement interpretation, and model output calibration |

| DevOps / MLOps Engineer | 1.0 | Infrastructure automation, CI/CD pipelines, model deployment automation, and observability implementation |

Supporting Evidence

Performance Targets

≥70%

<15%

12-20% reduction in forecasted fraud categories

20-35% reduction in investigation time per case

Team Qualifications

- KlusAI's network includes professionals with graph machine learning and financial services analytics experience, assembled specifically for each engagement's requirements

- Our teams combine technical ML expertise with European regulatory knowledge, including professionals familiar with PSD2, GDPR, AMLD, and DORA compliance frameworks

- We bring together specialists in financial crime domain knowledge and enterprise integration patterns, tailored to the specific core banking and payment infrastructure of each client

Source Citations

€4.2 billion in 2024, up 17% from 2023

"EUR 4.2 billion in 2024. This represents a year-on-year increase of EUR 602 million or 17%"exact

credit transfers €2.5 billion; 85% user-borne losses; 17x higher cross-border fraud

"EUR 2.5 billion... payment service users bore approximately 85%... 17 times higher"exact

up to €1 billion in projected fraud losses for Instant SEPA

"Instant SEPA faces up to €1 billion in fraud losses"exact

10x higher fraud risks in instant payments

"fraud risks are significantly higher in instant payments – up to 10 times"exact

Ready to discuss?

Let's talk about how this could work for your organization.

Schedule a Consultation

Pick a date that works for you

Times shown in your local timezone ()

Prefer email? Contact us directly

Almost there!

at

Your details

at

You're all set!

Check your email for confirmation and calendar invite.

Your booking is confirmed! Our team will reach out to confirm the details.

Your consultation

· min

( team time)

Quick Overview

- Technology

- Predictive Analytics

- Complexity

- high

- Timeline

- 5-7 months

- Industry

- Finance

- Region

- European Union